Field Name

Optional System Calculations (using Toolkit)

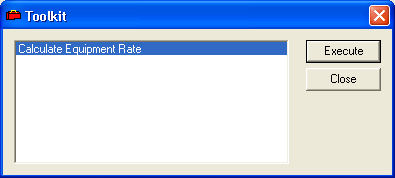

To access this feature, select the Toolkit  option on the main menu bar. You will see the following window:

option on the main menu bar. You will see the following window:

Select Execute, and the system will run the calculations for Depreciation Amount, Book Value, and Hourly Rate. After the Toolkit has ended its run, refresh the record to view the final calculations. These calculations are described below.

Depreciation Amount

This is a straight-line depreciation amount that the system calculates in the following manner:

- Determine TMD: Service Life*12 = Number of Months for Depreciation

- Determine Date of Last Full Month (LFM): e.g. if System Date = 4/7/2005 then LFM = March 31, 2005; if System Date = March 31, 2005 then LFM = February 28, 2005.

- Determine First Month of Depreciation (FMD) and set to the first day of that month: e.g. April 14, 2001 would be set FMD to 4/1/2001 and April 16, 2001 would be set to 5/1/2001.

- Determine months between LFM and FMD = MD

- Final Calculation: (MD(Purchase Amount - Salvage))/TMD = Depreciation Amount

Book Value

Reflects the remaining value using the following calculation:

Purchase Amount - Depreciation Amount = Book Value

Hourly Rate

Takes into consideration all equipment with an operating status less than 950. This calculation totals all costs spent on an equipment item. That number is then divided by the total average hours to reach the Hourly Rate value.

Total costs/Total Average Hours = Hourly Rate