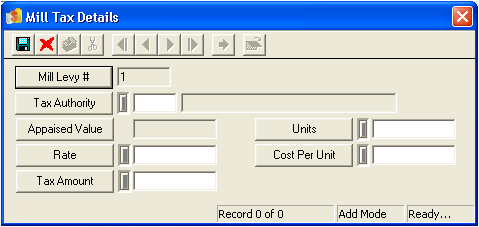

Note: This is required in order to save the record.

to save the record.

to save the record. to exit Add Mode.

to exit Add Mode. to close the window.

to close the window.Notes: The system will automatically add each mill tax entered in this grid to find the total amount of taxes due. This sum will be found in the Fees Due field on the General tab. To recalculate the total amount due (including interest) after an additional mill levy record is added, press F5 with your cursor in the Full Due field while in Edit Mode. You can use the functions in the Mill Tax Details grid to view, edit, or delete existing tax records. When tax records are deleted from the grid or edited and then saved, press F5 with your cursor in the Full Due field to recalculate the value.